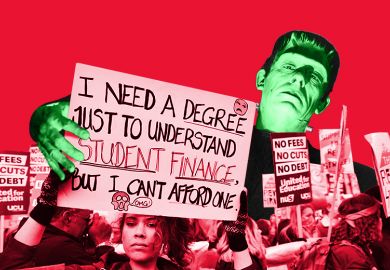

When English tuition fees were tripled in 2012, much concern was aired about the potential deterrent effect on young people from poorer backgrounds. In reality, the concern that such students would eschew higher education proved largely unfounded because of the existence of the income-contingent student loans system.

However, a much less widely discussed worry did prove more substantive: the effect on Muslim students of being, in their eyes, obliged to contravene their religion’s prescription to avoid riba – equivalent to “economic exploitation” but usually translated as “usury’.

According to the 2022 Muslim Census Survey, the UK’s growing Muslim community accounts for about 12 per cent of all students: around 45,000 a year. However, it also found that roughly 6,000 Muslim students a year decline to pursue university education altogether because of religious concerns about the financing arrangements. An additional 6,000 self-fund rather than take out the loan – and many of them report negative personal effects, such as reduced choice and additional stress.

In addition, 80 per cent of Muslims who had taken out student loans felt conflicted because of their religious concerns; no doubt this includes many who were able to rationalise paying their tuition fees via the loan since these are non-negotiable, while simultaneously foregoing the optional maintenance loan, with effects on their living standards and ability to study.

Hence, by explicitly equating student finance to a tax rather than loan earlier this year, the British Board of Scholars & Imams (BBSI) has rendered an important service to observant Muslim students, parents and stakeholders – and to the wider British community, too.

Among Islamic scholars, the perception that interest on loans is usurious is far from universally endorsed. Indeed, at this juncture, it appears that a majority of suitably trained jurists conversant with UK student finance (including the influencer and scholar Yasir Qadhi) agree the student loan is permissible. The BBSI’s guidance document, issued earlier this year, independently echoes such verdicts.

It also reflects efforts by campaigners such as the noted financial journalist Martin Lewis to demystify and demythologise England’s student financing system. Taking out a student “loan” is all too often detrimentally perceived as the acquisition of debt, compounded by interest, even though these concepts are purely notional in an income-contingent repayment system in which only the top 17 per cent of earners are likely to pay back their “loan” in full.

Ranged against such a relabelling of student finance arrangements are politicians who fear being associated with yet another “tax”, as well as Treasury officials, who believe that any psychological means to encourage repayment represents fiscal prudence, never mind the detrimental effect on the potential of some of the most marginalised elements of British society.

The BBSI’s solution to the government’s insistence on problematic vocabulary is to “strongly recommend” that ministers proceed with previous promises to introduce Shari’ah-compliant Alternative Student Finance (ASF), seemingly as a contingency against future unwelcome developments in repayment conditions that would make the student loan look more usurious.

Nor is it alone among Islamic organisations in making this call. But such well-intentioned advocacy is nevertheless misguided. Given the widely acknowledged fact that there is little meaningful difference between student loans and graduate tax, ASF is pointless – and is likely to be subject to unpredictable demand over the long term – including, potentially, from students who do not identify as Muslim.

Instead, public perceptions – of Muslims and everyone else – will be better addressed through appropriate educational efforts via the provision of improved information focused on rebadging and reconceptualising student finance as a graduate contribution, not debt.

Given the lack of incentive from officialdom for government websites to change the narrative, however, it is particularly crucial that information from advisers, university websites and similar resources intended for students, including committed Muslims, robustly reflects these realities.

Currently, even university sites err on the side of caution by tending to uncritically adopt the student loan-cum-debt framing, but there are easy gains to be made. A more accurate depiction of the real nature of student finance has the potential to boost student enrolment – and very much not exclusively from among the burgeoning Muslim community.

Notwithstanding the need to address the current pressure on university finances due to frozen fees, we should celebrate a fair and rather progressive method of funding student tuition and maintenance in the face of competing demands on the public purse. Universities should do all they can to boost public understanding that income-contingent student loans are a far better option than those available in certain other countries, where predatory, exploitative and perennial loans really do exist.

Steve Connolly is undergraduate education coordinator in the Department of Life Sciences at Imperial College London.

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber?