The Westminster government has been urged to outline its “tests” for when it would or would not intervene to rescue an English higher education provider from insolvency, with geography predicted to be a central determining factor for ministers.

Institutions in London are more likely to be allowed to go bust than those elsewhere, experts told an event organised by the Policy Institute at King’s College London looking at “financial failure in higher education”, because the capital would be able to absorb the ramifications, both in terms of displaced students and the local economic impact.

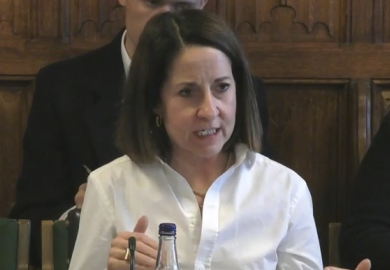

“My sense is when it comes to where governments would step in, it comes down far more to geography than with having a shake-out of the system to have different evolving institutions,” said Baroness Wolf of Dulwich, a professor of public sector management at King’s and former adviser on skills in the No 10 Policy Unit.

“Bluntly, there are geographical areas where you just don’t let it close down. Either for raw politics or for labour market reasons…It really does matter if this chunk of the country is left without a properly functioning institution.”

While the impact of an institutional collapse in London “would be enormous for students”, it would be felt less keenly by the city as a whole than in more regional, rural areas, agreed Jess Lister, associate director (education) at the consultancy Public First.

Many areas have a single institution that functions as both a large-scale education provider and a major employer that is integral to local supply chains and the economy, Ms Lister said, and the loss of such a university would be akin to a large private-sector company going bust.

She said the government had not outlined its tests for which institutions it would save and which it would not, with the impact on growth, public services, science and research and the loss of certain specialisms all potential areas to consider.

Panellists agreed that there was a risk of contagion should any university become insolvent, with one bankruptcy potentially becoming five or 10 because of the knock-on impact on student recruitment and market confidence.

Sir Steve West, vice-chancellor of the University of the West of England, said neither the sector nor the government seemed prepared for a market exit and student protection plans required by the regulator, the Office for Students, were “not fit for purpose”.

He pointed out that if students needed to be moved to another institution, it might be possible to find them a similar course in London, but in areas with few institutions, it would be far more difficult, particularly as many cater to commuter students who attend the university nearest their family home and would struggle to travel further afield.

“There will be political decisions that will be made which will be around the government imperative to make sure some things stay and deliver,” he said. “And there will be others where they may take a view that ‘we have got lots in this area and we’ll let that one fail’.”

Neil Smyth, a partner at the law film Mills & Reeve, said there was a “severe lack” of insolvency processes open to the higher education sector because most institutions are not companies and therefore processes used elsewhere do not apply.

There was a need to create a special administration regime for higher education, he agreed, but this would be a long process that could outlast the current financial headwinds that are causing the most acute problems.

Legislation could, however, assist in other ways, according to Mr Smyth, by providing clarity about the personal liability of trustees, introducing a specific duty on the interests of students and by providing some detail to “confused” lenders about how they might recover their money, which might influence their funding decisions.

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber?