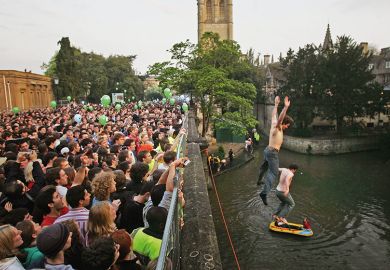

Source: Alamy

Heathrow bonanza: infrastructure investments ‘will deliver’ in the long term

For someone heading a pension scheme with a £7.9 billion deficit, Bill Galvin appears remarkably unfazed.

But the recently appointed chief executive of the Universities Superannuation Scheme, the sector’s main pension fund, is used to dealing with similar shortfalls, having finished a three-year spell as chief executive of the Pensions Regulator in June.

Presented with black holes in companies’ pension schemes and their plans to fill them, Galvin and his team at the watchdog ruled on whether the firms were taking too much risk (or not enough) with the future of their funds.

Now on the other side of the fence, Galvin is planning to submit a report to his old employer about the yawning USS deficit ahead of its next triennial valuation in March.

What this might mean for some of the scheme’s 300,000 members, including 148,000 contributing university staff, remains unclear.

Major reforms to ensure the USS’ long-term future have already been taken: final-salary schemes were closed to new members in 2011 as contributions and the retirement age were raised.

Increasing contributions from universities and members has been suggested once again because the USS’ deficit rose almost fourfold from £2.9 billion in March 2011 to £11.5 billion in March 2013. This dropped to £7.9 billion in June as interest rate rises reduced the cost of the scheme’s liabilities, leaving 83 per cent of the USS’ promised pensions covered by assets worth £37.9 billion.

Some experts have argued that the USS deficit would be even higher – £10.5 billion – if the accounting methods used by other large funds were employed.

“There is a huge amount of volatility and not all these figures are sensible numbers for long-term planning,” says Galvin in an interview with Times Higher Education.

“I don’t think we should ignore market conditions, but we should use them as a starting point to make a sensible judgement on the strength of the sponsors and the ability of the scheme to look to the future.”

‘More levers to work with’

The relative strength and diversity of the USS’ backers (more than 400 higher education employers, mainly pre-1992 universities, pay into the scheme) means that the fund can eschew knee-jerk increases to contributions to plug its deficits, Galvin adds.

“Closed schemes with a single sponsor cannot afford to take big risks,” he says. “If they get it wrong, they do not have time to recover: open schemes such as the USS have more levers to work with.”

However, while he believes that defined benefit schemes such as the USS can survive in today’s marketplace (despite almost all private companies closing theirs), further changes may need to be made.

“Pensions are not a set-and-forget activity,” he says. “It is important that people acknowledge that the financial environment has changed substantially since 2008, and the assumptions of the early 2000s about future returns…have to be revisited.”

The pensions industry has long underestimated people’s longevity as well as the costs of providing future benefits, he argues.

“It is a process of assumptions and adjustments,” Galvin says. “We are moving into…considering if contributions are suitable for the current benefit structure.”

He is keen to stress that the USS is better placed than most pension schemes to ride out the current financial uncertainty, particularly thanks to the efforts of its new in‑house investment team, which is targeting long-term infrastructure projects (and has already taken a £392 million stake in Heathrow airport).

While the USS’ investments will continue to include British American Tobacco – a fact raised by anti-smoking campaigners each year at the University and College Union congress – he believes that the fund’s overall focus on the long term will be rewarded, allowing it to build on last year’s impressive 14 per cent return on assets.

“The market rewards people who are able to lock money away for the long term,” he says.

“Making careful investments in places such as Heathrow will deliver long-term inflation-adjusted returns.”

Altogether now: place for support staff funds in USS?

Pension schemes run by universities for their support staff could be merged with or transferred to the Universities Superannuation Scheme, employers have suggested.

In a report by the Employers Pension Forum for Higher Education, several options are outlined for the 36 individual schemes run mainly by pre-1992 universities to ensure that they address continuing pension costs and risks.

According to the Self‑Administered Trusts Strategy Project Report, the schemes on average were 23.2 per cent underfunded as of July 2012, with two-thirds reporting worsening deficits that year.

That deficit level is slightly better than the USS’ at the same point, while employer and employee contributions are broadly similar to the sector’s main fund.

Moving the pension schemes to the USS is a possibility and some universities have already enquired about doing so, the report says.

But larger schemes may not wish to give up control of their terms and conditions to a nationwide fund, the report says.