Ministers have stepped in to cap the amount of interest that will be levied on English student loans, although graduates still face a hefty rise in the cost of borrowing.

The maximum rate of interest on student debt, currently 4.5 per cent, had been due to rocket to 12 per cent this autumn, as it tracks the retail price index (RPI) measure of inflation, with an additional 3 per cent added on.

Ministers have now stepped in to cap rates at 7.3 per cent, which they said was in line with the “forecast prevailing market rate” for comparable unsecured personal loans.

The Department for Education said that, for a borrower with an outstanding balance of £45,000, this would reduce their accumulating interest by about £180 per month, compared with a 12 per cent rate – although monthly payments are unaffected, because these are based on earnings.

The cap is expected to remain in place for 12 months.

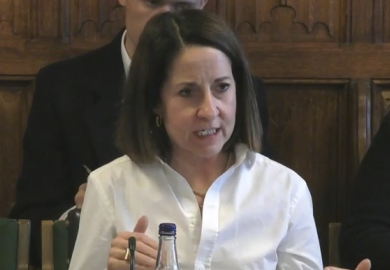

Michelle Donelan, the higher education minister, said the government would “help with rising prices” where it could.

“I will always strive for a fair deal for students, which is why we have reduced the interest rate on student loans down from an expected 12 per cent,” Ms Donelan said.

“I want to provide reassurance that this does not change the monthly repayment amount for borrowers, and we have brought forward this announcement to provide greater clarity and peace of mind for graduates at this time.”

Larissa Kennedy, the president of the National Union of Students, said the interest rate was still “cruelly high” and highlighted that many students were struggling with their living costs while they were at university.

“While some graduates might breathe a sigh of relief that the interest rate is no longer in double figures, ministers should be prioritising providing urgent cost of living support here and now,” she said.

Reforms that will apply for students starting higher education from September 2023 onwards will cap the student loan interest rate at RPI.

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber?