Source:

Lloyds Bank

Adding Strong Customer Authentication to online payments will benefit higher education

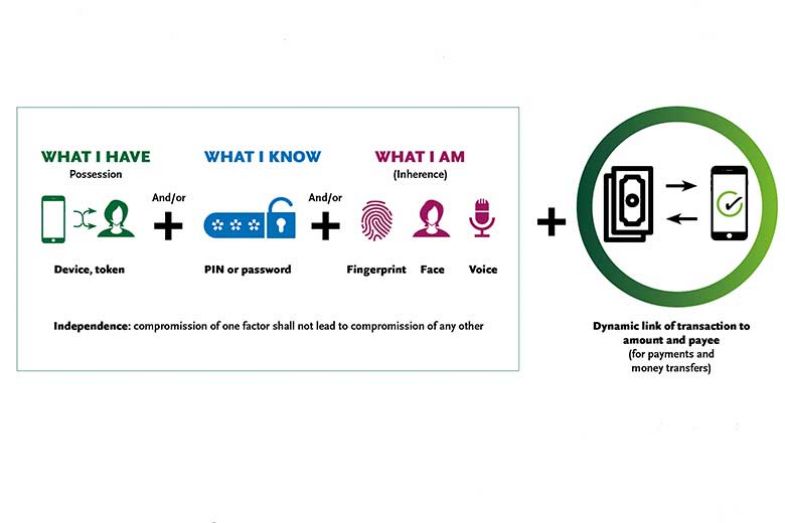

Online card payments are changing. Strong Customer Authentication (SCA) is a European regulatory programme that focuses on increasing the security of online payments.

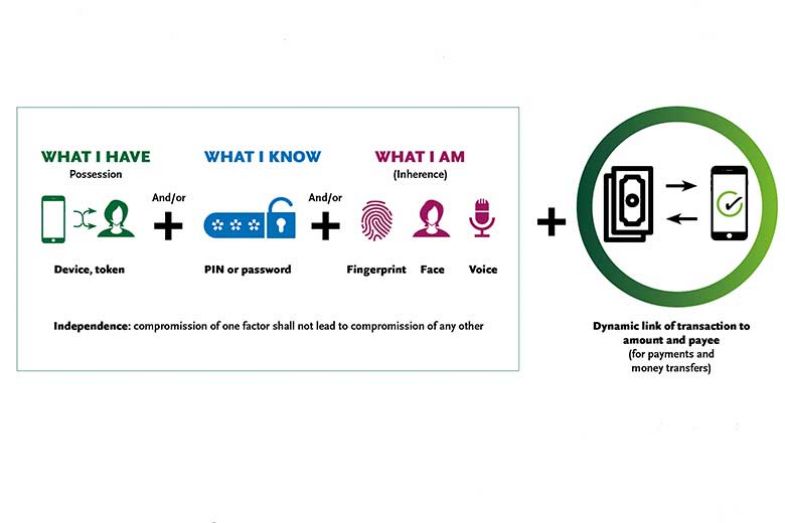

All banks will be asking their cardholders to authenticate themselves using two methods. These can be something that they know (eg, a password), something that they have (eg, a mobile phone) or something unique to them (eg, a fingerprint).

They will need to do this when accessing their bank accounts, making online payments or completing other high-risk transactions.

Some issuers will use a biometric method of authentication, such as fingerprints or facial recognition. Other issuers will initially implement SCA by using a one-time pass code sent via SMS to the customer’s mobile phone for each online transaction.

How Strong Customer Authentication will affect universities

It is expected that payments for tuition fees and accommodation will need SCA, because about 90 per cent of university card spend processed online is for these two costs.

Also, if universities have online shops, payments to these will require SCA.

Preparing for Strong Customer Authentication

SCA uses 3D Secure, so universities need to make sure they have this set up and that their payment process integrates with it.

Strong Customer Authentication exemptions

Under SCA, there is less opportunity to make exemptions from 3D Secure authentication. However, the following payments will not require SCA:

- Payments from outside the EEA

- Transactions below £30

- Subscriptions and recurring transactions

- White-listed transactions from cardholders that use a website frequently

To fully understand when SCA must be used and when there is an option to not use it, universities should work closely with their payment services provider and bank.

What Strong Customer Authentication can offer universities and customers

As well as the additional security it provides, SCA should offer universities savings in terms of fewer chargebacks and disputed transactions, and the admin costs and time associated with these.

Parents and students will benefit from the reassurance that their card details are safe, as well as simpler online payments.

The upgraded process, 3D Secure 2, is optimised for mobile, so fits the way that students prefer to make payments.

Universities get support from Lloyds Bank

We have been supporting universities in getting ready for SCA through thought leadership events, white papers and strong links to scheme-owned payment services providers. We are also working with universities to ensure the correct transactions are exempt from SCA. Plus, we can help with universities’ understanding of exemptions, providing a secure environment and reducing friction for universities, parents and students.

- If you would like to discuss how Strong Customer Authentication will impact your university and its customers, please speak directly to Simon Tye, associate director, Global Transaction Banking at Lloyds Bank, on 0808 274 3634.

This article is produced for general information only and should not be relied on as offering advice for any specific set of circumstances. Lloyds Banking Group is a financial services group that incorporates a number of brands including Lloyds Bank. More information on Lloyds Banking Group can be found at lloydsbankinggroup.com. This article is produced for general information only and should not be relied on as offering advice for any specific set of circumstances.