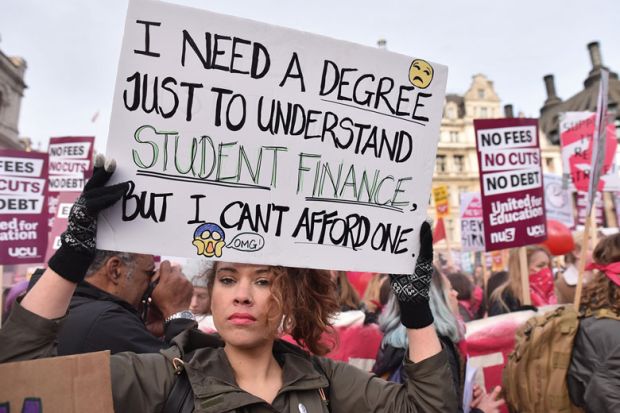

Feelings of “anxiety” and “dread” among graduates over their student loan debt are greater for those who went to university after the trebling of fees in England in 2012, according to a report warning that government missteps on loan changes hit graduates’ “life choices and opportunities”.

The report for the Higher Education Policy Institute, published on 25 November, came as the Westminster government was expected to unveil changes to loan terms and conditions that will mean graduates paying more towards their loans.

The report was written by Claire Callender, professor of higher education studies at the UCL Institute of Education and at Birkbeck, University of London, and Ariane de Gayardon, a researcher at the University of Twente’s Center for Higher Education Policy Studies. They based their analysis on interviews with 48 graduates subject to the 2006 funding regime (cohort 1, repaying annual tuition fees of £3,000-plus, with outstanding loan balance written off after 25 years) and 50 subject to the 2012 regime (cohort 2, repaying annual fees of £9,000-plus, with outstanding loan balances written off after 30 years).

While graduates interviewed were happy with protections offered by the income-contingent nature of loans and generally felt that monthly repayments were affordable, “tuition fees are seen as too high”, the “amount of debt owed is experienced as a burden”, “interest rates are regarded as too high” and “the repayment period feels never-ending”, according to the report.

“Student loan debt is experienced as a burden by graduates to various degrees but especially among those who entered higher education after the 2012 funding reforms,” it says. These graduates “talk about feelings of anxiety, pressure, worry and dread about the ever-present and growing debt hanging over them”.

Graduates “are keen to be free of their debts, but most cohort 2 graduates believe they will never repay the money they borrowed – adding to the psychological toll of student loan debt”, the report adds.

Under the current system, 80 per cent of graduates will likely never pay back their loans in full, according to the Institute for Fiscal Studies.

Graduates “describe being deterred from further study because they do not want to add to the considerable amount of debt they had already accrued”, the Hepi report says. “Debt also plays a role in job decisions, such as feeling under pressure to get a well-paid job so that repayments can start. In doing so, some people divert away from a career path connected to their degree.”

The report recommends that “future reforms should consider the way different features of the cost-sharing and student loan system are experienced by graduates and how they affect the psychological cost of student loan debt…Ill-devised changes could come at the expense of graduates’ life choices and opportunities – affecting the lives of generations to come and of a growing proportion of the electorate.”

Professor Callender told Times Higher Education that “despite the safeguards built into the system” – the income-contingent nature of loans and the fact that outstanding balances are written off after 25 or 30 years – “there’s clear evidence from this rigorous research that some graduates remain very anxious and fearful about the whole loan system and about the repayments”.

“Certainly, the anxiety is much greater among those who paid tuition fees of £9,000,” she added.

A Department for Education spokeswoman said: “The student finance system was built with students’ interests in mind, so that all those with the talent and desire to attend higher education are able to do so, regardless of their background.

“Repayments depend on the borrower’s income, ensuring that loans remain affordable, whilst fairly sharing the cost of higher education between graduates and the taxpayer.

“We remain committed to driving up the quality of standards and educational excellence alongside ensuring a sustainable and flexible student finance system. We will set out further details of the higher education settlement and our response to [the] Augar [review of sector financing] in due course.”

Register to continue

Why register?

- Registration is free and only takes a moment

- Once registered, you can read 3 articles a month

- Sign up for our newsletter

Subscribe

Or subscribe for unlimited access to:

- Unlimited access to news, views, insights & reviews

- Digital editions

- Digital access to THE’s university and college rankings analysis

Already registered or a current subscriber? Login