Working with businesses is one of the cornerstones of university activity. Across the country, there are clusters of specific industry excellence that bring together high-tech firms and academic expertise.

The South West of England is a major hub for the aerospace industry and involves the universities of Bath, Bristol, Exeter and Plymouth, for example, meanwhile the Midlands excels in advanced manufacturing with the help of the universities of Warwick, Birmingham and Aston.

In these clusters, many high-tech businesses work in close collaboration with universities to give them a leading edge. Local “Catapult centres” also help to bring new ideas to market with the help of academics.

The departure of any major corporations from these clusters could not only result in job losses and a fall in business research and development spending, but there could be knock-on effects for suppliers, many of whom also work closely with universities, and the innovation system overall.

But it is not all gloom and doom. Novo Nordisk, the Danish pharmaceutical giant, announced last week that it was investing £115 million in a new research centre at the University of Oxford despite the prospect of Brexit.

Rebecca Lumsden, head of science policy at the Association of the British Pharmaceutical Industry, said that this was not a surprise because the university has leveraged a lot of funding to build significant expertise in areas important to the company.

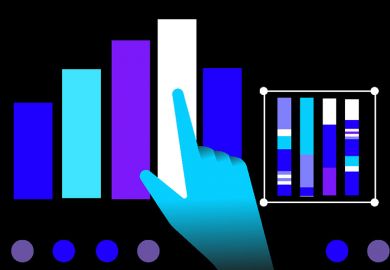

In fact, Oxford is in the top three when looking at industry income per academic across all disciplines (see table).

| Research grants and contracts income from industry, commerce and public corporations (£ per academic) 2013-14 | |

| Cranfield University | 41,032 |

| Imperial College London | 34,251 |

| University of Oxford | 29,232 |

| University of Cambridge | 17,702 |

| University of Strathclyde | 14,179 |

| University of Manchester | 12,757 |

| University of Sheffield | 12,381 |

| University of Aberdeen | 12,179 |

| University of Dundee | 11,557 |

| London School of Hygiene and Tropical Medicine | 10,760 |

Source: Hesa. Institutions with fewer than 200 FTE academic staff excluded.

The reason many global companies chose to invest in the UK is the strength of the research base. The government must be careful not to undermine this by starving it of funding in the wake of Brexit, especially if academics are to lose access to European research funding.

But alongside uncertainty comes opportunity and, as one commentator pointed out after the Novo Nordisk announcement, Brexit has made investing in UK science 20 per cent cheaper because of the falling pound.