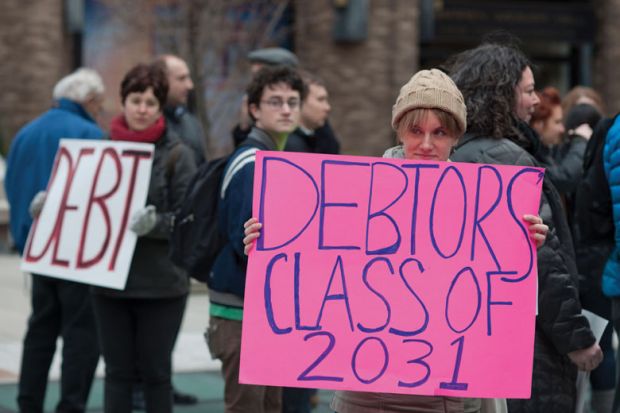

Despite US student loan debt passing the $1 trillion (£770 billion) mark, the idea of a systemic loans crisis is a “fictional narrative” that hinders solutions to the real problems, according to the co-author of a new book.

The creation of a single federal income-contingent loans system would work better than offering interest rate relief to borrowers under the current system, according to Beth Akers, co-author of Game of Loans: the Rhetoric and Reality of Student Debt, to be published next month by Princeton University Press.

State-run, income-contingent loans are used in higher education systems including England and Australia. Although the US federal loans system offers some income-contingent repayment plans, the current variety of different loan schemes is described as “impossibly difficult to navigate for consumers” by Dr Akers.

However, the book says that there is “no evidence of a widespread, systemic student loan crisis, in which the typical borrower is buried in debt for a college education that did not pay off”.

Dr Akers, a fellow at the Brookings Institution thinktank in its Center on Children and Families, told Times Higher Education: “What happens when we talk about this fictional narrative is we miss the fact that there are very real problems – and the solutions that come out of the discussion of this fictional narrative in fact don’t solve the real problems we have on the table.”

Plans for student loan interest rate cuts from Democratic politicians including presidential nominee Hillary Clinton were “a great example of mischaracterisation of the student loans crisis leading to a solution that just doesn’t solve the real problems that we’re facing”, Dr Akers added.

She also said that “when we look at who is struggling financially, in fact it is not the people with the largest debt burden...who tend to have the highest earnings [after graduation]", but those who may have “very low balances but also low earnings potential”.

The book, co-authored with Matthew M. Chingos, senior fellow at the Urban Institute, cites figures from the Federal Reserve Bank of New York suggesting that total outstanding student debt passed $1 trillion in 2013.

“I see that as a symptom of a growth in investment in human capital,” said Dr Akers. “Whereas to some people it’s a very scary number, to me it reflects something we generally think of as a positive thing.”

Dr Akers said the risk of investing in higher education “works out just fine for a large number of students – the ones who see those positive returns that are happening on average statistically – the problem comes from people who basically play the education lottery but lose.

“These income-driven repayment systems are really a great way of providing a social insurance that provides relief only to people who are in that position of having made the investment and having it not pay off.”

Dr Akers said that although making public college tuition free – as Ms Clinton has proposed doing for the majority of US families – would be a “viable” way of “mitigating the risk entirely and placing it on to taxpayers rather than individual students”, it was also seen by some as “a very regressive policy” as “a lot of the benefits of free college would accrue to the people who are already very well off”.

She said that Ms Clinton’s higher education plan was “well thought out – whether I agree with it or not” and also included language that “makes me think that one of the pieces [in the policy plan] would be to move towards a more universal repayments system, which would likely be income driven”.